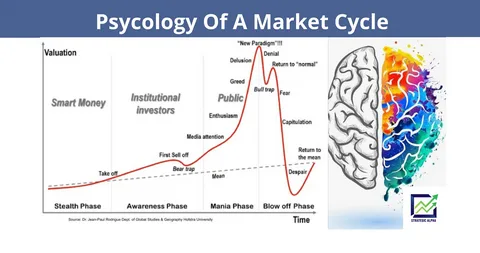

Investing isn’t just about numbers and charts; psychology plays a crucial role in determining success or failure. Emotional decisions often lead to poor investment outcomes, which is why understanding behavioral finance is essential.

One common bias is fear and greed. During market booms, greed pushes investors to buy at high prices, expecting endless growth. During downturns, fear causes panic selling at losses. Both behaviors contradict the golden rule of investing: buy low, sell high.

Another bias is herd mentality. Many people follow the crowd without proper analysis, leading to bubbles or sudden crashes. Similarly, confirmation bias causes investors to seek only information that supports their beliefs, ignoring red flags.

Discipline and patience are key. Successful investors create long-term strategies and stick to them, regardless of short-term volatility. Tools like automated investing, dollar-cost averaging, and diversified portfolios help minimize emotional interference.

Warren Buffett famously said, “Be fearful when others are greedy and greedy when others are fearful.” This mindset emphasizes rational thinking over emotional reactions.

In conclusion, mastering the psychology of investing is as important as financial knowledge. By recognizing biases and controlling emotions, investors can make smarter, more consistent decisions for long-term wealth building.