When it comes to investing, two of the most common options are real estate and the stock market. Both have the potential to generate wealth, but they differ significantly in terms of risk, liquidity, and returns. Understanding these differences can help investors make better decisions.

Real estate is often seen as a stable, tangible asset. It provides rental income and long-term appreciation. Many investors value the sense of security that comes from owning property, as well as the potential tax benefits. Real estate also acts as a hedge against inflation since property values and rents tend to rise over time.

However, real estate has downsides. It requires large upfront capital, ongoing maintenance, and may be difficult to sell quickly. Market downturns or location issues can also impact property values.

The stock market, on the other hand, offers higher liquidity and accessibility. Investors can start with small amounts, diversify easily, and sell shares whenever needed. Historically, stocks have delivered higher long-term returns compared to real estate.

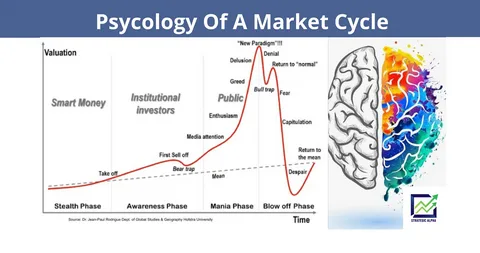

But stocks are volatile. Prices can fluctuate daily, influenced by economic conditions, company performance, or global events. Emotional decision-making often leads to losses for inexperienced investors.

In conclusion, there is no one-size-fits-all answer. Real estate provides stability and income, while stocks offer growth and liquidity. Many successful investors choose to diversify across both to balance risks and maximize returns.